How Consumer Loyalty is Shifting in the Battle Between Private Labels and National Brands

In the evolving landscape of consumer goods, the battle between private labels (also known as store brands) and national brands has become increasingly intense. Once considered cheaper alternatives, private labels have undergone a transformation in quality, packaging, and marketing, positioning themselves as strong competitors to traditional national brands. With inflation, changing consumer preferences, and shifts in shopping behaviors due to technological advancements, consumer loyalty is gradually moving in unexpected directions.

The Rise of Private Labels: More Than Just a Budget Option

Private labels have traditionally been viewed as low-cost alternatives to national brands, appealing primarily to price-sensitive shoppers. However, in the last decade, the narrative around private labels has significantly evolved. Major retailers like Amazon, Walmart, and Aldi have invested heavily in developing high-quality, private-label products that rival or even exceed the quality of their national brand counterparts.

Key Factors Fueling the Growth of Private Labels:

- Quality Improvements: Modern private labels offer products that often match or surpass national brands in terms of ingredients, innovation, and value for money. Retailers like Trader Joe’s and Costco (Kirkland Signature) have built entire business models around private label products, which are perceived by consumers as premium but affordable options.

- Variety and Niche Offerings: Private labels are no longer limited to staples like canned goods and paper towels. Many retailers now offer organic, gluten-free, or plant-based products under their private labels, catering to niche consumer preferences.

- Increased Consumer Trust: With consistent quality and positive experiences, consumers have grown to trust store brands. Retailers leverage their brand name to back their private labels, assuring customers of value and reliability.

As a result, private label products are no longer merely substitutes—they are now destination products that consumers seek out specifically for their value proposition.

Changing Consumer Behavior: The Influence of Economic Conditions

Economic factors, particularly inflation and recessionary concerns, have played a major role in the rise of private labels. According to a 2022 study by McKinsey, 45% of consumers shifted their brand loyalty during economic downturns, opting for more affordable private-label options. As prices of national brands have surged, consumers have been more open to experimenting with private labels, especially when these products offer a strong balance of price and quality.

The Role of Inflation and Price Sensitivity

Inflation has forced many consumers to reassess their shopping habits. National brands, facing increased production and supply chain costs, have raised prices to maintain margins. Private labels, benefiting from their integration within retail supply chains and having fewer marketing and distribution costs, have maintained relatively stable prices, making them attractive alternatives.

This shift in behavior isn’t just about short-term savings. Research has shown that when consumers switch to private labels during times of economic hardship, many continue to buy these products even after their financial situation improves, especially if the product quality meets or exceeds expectations.

National Brands Fighting Back: Innovation and Brand Loyalty Programs

As private labels grow in market share, national brands are not sitting idle. They’ve recognized the threat posed by private labels and have responded with strategies aimed at solidifying consumer loyalty and maintaining their competitive edge.

Innovation and Product Differentiation

One of the most significant responses from national brands has been product innovation. Big brands are doubling down on research and development, releasing new products that offer unique flavors, formulations, and functionalities. For example, in the food industry, brands like Coca-Cola and PepsiCo have introduced low-sugar, organic, and functional beverages to cater to health-conscious consumers. National brands are also focusing on sustainability, offering eco-friendly packaging or ethically sourced ingredients to appeal to conscious consumers.

Loyalty Programs and Personalized Marketing

National brands have also leveraged loyalty programs to foster deeper connections with consumers. Companies like Procter & Gamble and Unilever use personalized marketing and rewards programs to incentivize repeat purchases, offering exclusive discounts, early access to new products, or even personalized product recommendations based on past purchases. By creating these ecosystems, national brands aim to build loyalty not just through the product itself, but through the overall shopping experience.

The Role of E-commerce and Technology in Shifting Loyalty

The growth of e-commerce has played a pivotal role in changing the dynamics between private labels and national brands. Online shopping platforms have allowed private labels to compete on a more level playing field. Retailers like Amazon have aggressively promoted their private-label products, from household items to electronics, often positioning them as default recommendations.

The Power of Online Reviews and Comparison

With the rise of online shopping, consumers have become more informed and empowered to make direct comparisons between products. Private-label goods that previously would have been overshadowed by national brands on physical store shelves can now be discovered through online reviews and recommendations. In many cases, customers are swayed by peer reviews rather than brand reputation, making it easier for private labels to gain traction.

National brands have had to adapt by enhancing their digital presence. Many are investing heavily in online marketing, influencer collaborations, and direct-to-consumer (DTC) sales to strengthen brand loyalty. This digital-first approach allows them to gather valuable consumer data, personalize their offerings, and build a more engaged customer base.

Changing Consumer Preferences: The Shift Toward Value and Authenticity

Today’s consumers are more value-conscious than ever. This doesn’t just mean seeking the lowest price, but finding a balance between price, quality, and values like sustainability and ethical sourcing. Private labels, by offering cost-effective alternatives with a focus on transparency, have aligned well with these evolving preferences.

Trust and Authenticity

The rise of private labels is also tied to consumer desire for authenticity. Shoppers, especially Millennials and Gen Z, value transparency about ingredients, sourcing, and corporate responsibility. Retailers like Whole Foods, which offer high-quality private label products with clear ethical messaging, have capitalized on this trend, creating a strong emotional connection with consumers. In contrast, national brands that fail to align with these values may struggle to retain customer loyalty.

The Future of Consumer Loyalty: A Blended Approach?

As consumer loyalty continues to shift, it’s likely that future shopping patterns will not see a clear winner between private labels and national brands. Instead, a blended approach to consumer loyalty may emerge. Shoppers are becoming increasingly flexible, often selecting private labels for certain staple products while sticking with national brands for categories where they perceive added value, innovation, or status.

Hybrid Loyalty

The concept of hybrid loyalty suggests that consumers may not be exclusively loyal to either private labels or national brands, but will curate a mix of both depending on the product category. For example, a shopper might opt for private-label cleaning supplies but remain loyal to a premium national skincare brand.

This trend challenges both national brands and private labels to stay competitive, focusing on specific areas where they can dominate—whether through price, quality, innovation, or brand experience.

Conclusion: A Shift, Not a Battle

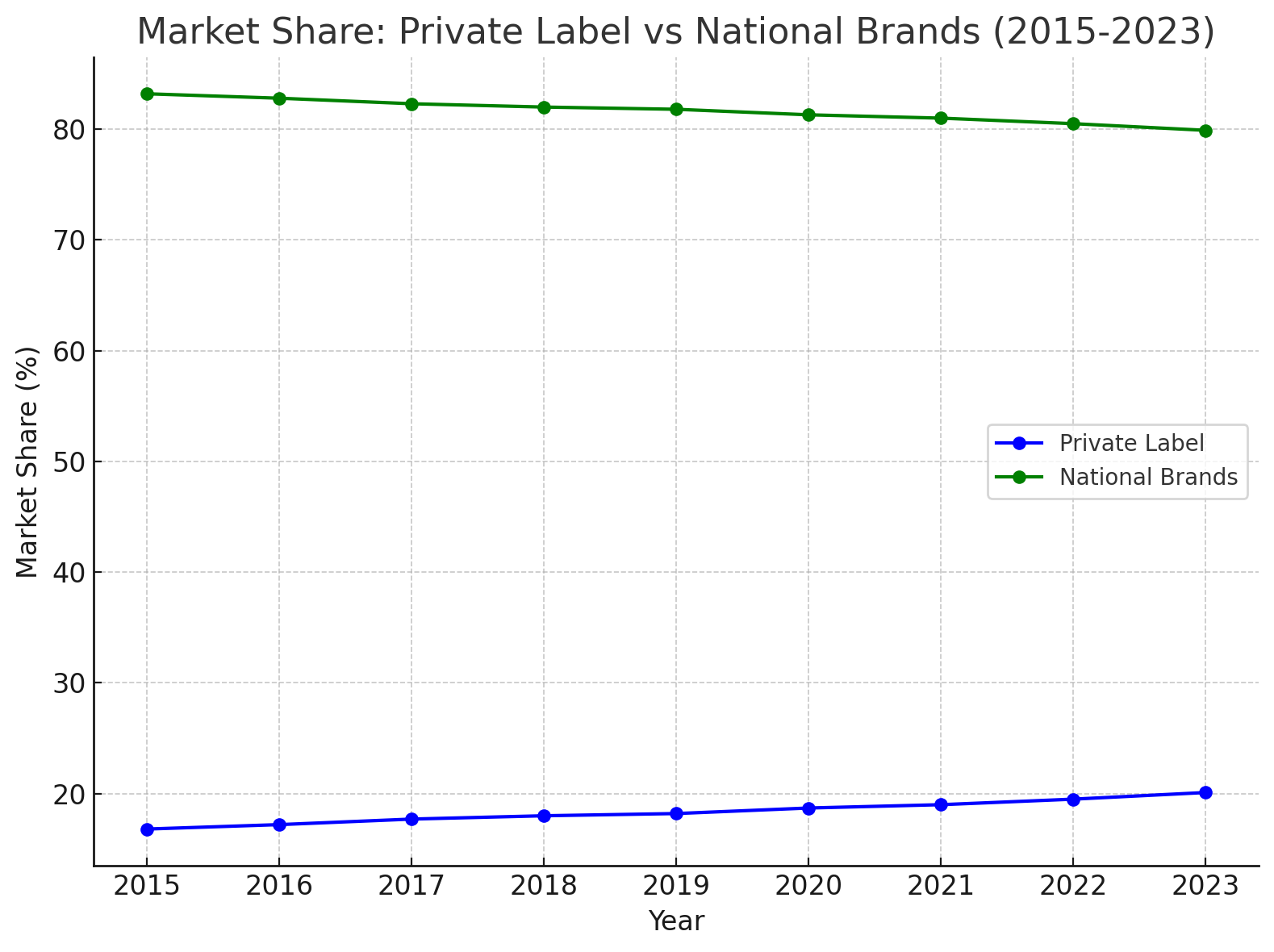

The competition between private labels and national brands is reshaping consumer loyalty, but it’s not a simple win-or-lose battle. As private labels become more sophisticated and trusted, they will continue to claim a larger share of the market, particularly in categories where value for money is paramount. At the same time, national brands can maintain loyalty by innovating and creating emotional connections through personalized experiences and alignment with consumer values.

For both sides, understanding the nuanced motivations of today’s shoppers—balancing quality, value, and brand trust—will be key to staying relevant in this shifting landscape.